libaba and Tencent, two of Asia’s most valuable companies, have made an array of investments as they build their ecosystems and go head-to-head in “new retail”

China’s technology triumvirate comprising Baidu, Alibaba Group Holding and Tencent Holdings have become some of the country’s most active investors, spending billions of dollars in a variety of industries, whether to support their own core operations or to diversify into exciting new areas.

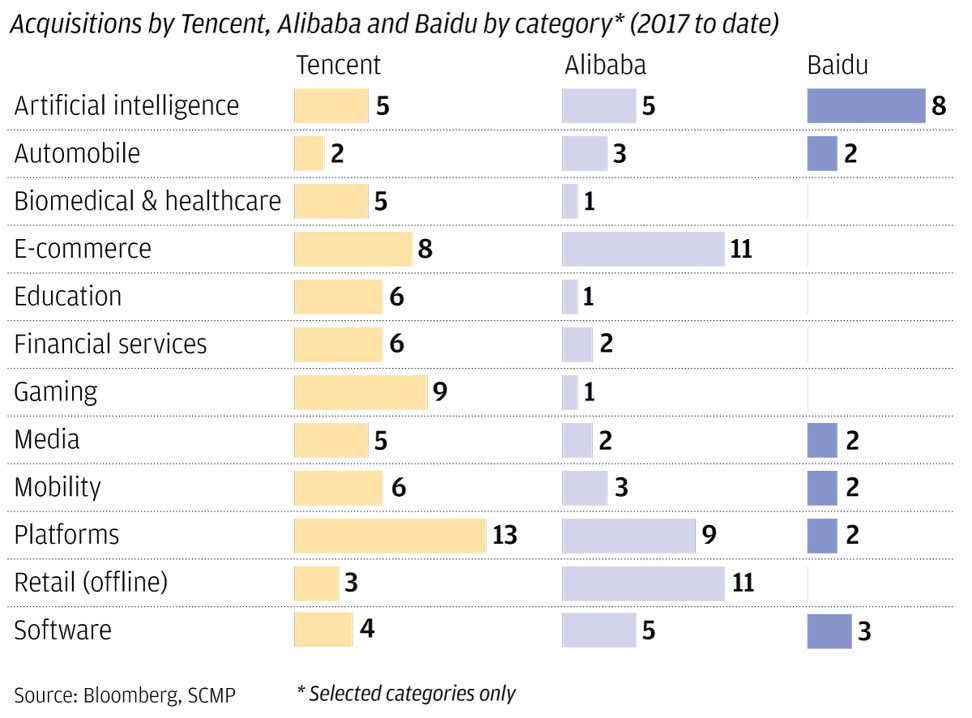

A look at available investment data shows that Tencent is the most active of the three, having taken part in at least 94 investment and merger and acquisition (M&A) deals since the beginning of 2017, according to data compiled using Bloomberg’s M&A function. That is almost 25 per cent more than Alibaba’s 74, and far exceeds Baidu’s 25 deals.

Broadly speaking, the three firms’ investments shine a light on how their business strategies are evolving. Alibaba and Tencent, which vie for the title of Asia’s most valuable company, have gone head-to-head as they gear up for a war targeted at the intersection between online and offline retail. The aim is to integrate offline retail – otherwise known as bricks-and-mortar – and e-commerce to create a seamless shopping experience for China’s 1.3 billion consumers.

SPENDING SPREE FOLLOWS US COUNTERPARTS

However, the investment splurge by Chinese technology companies is not too dissimilar to that of their US counterparts, many of which historically acquired or invested in firms that were deemed as key to future growth. Facebook, for example, bought photo-sharing app Instagram in 2012 and messaging platform WhatsApp in 2014, while Google acquired YouTube in 2006 and navigation app Waze in 2013.

“Companies like Baidu, Alibaba and Tencent have become like investment companies. They are sitting on top of piles of money and they are figuring out how to try and make the best use of it,” said Shaun Rein, managing director at China Market Research Group. “The rate of investments is increasing because they’re trying to stay ahead of each other. Their major business lines have got so big that they are not going to get the same growth they are used to and it’s faster to buy technology and market share than to grow it organically and sustain a similar pace of growth.”

Alibaba sees 2019 revenue growth above 60 per cent as it pushes beyond e-commerce

Soon after Alibaba founder Jack Ma Yun coined the term “new retail” at the end of 2016, the company went on an investment spree, snapping up stakes in Chinese offline retail companies with 11 deals worth at least US$6.9 billion. Alibaba then invested in 11 e-commerce ventures worth a total of US$4.5 billion, with over a third involving online grocers in China and India. Simultaneously, the firm rolled out its new retail Hema supermarkets across China, which enable users to shop both online and offline and have in-house chefs to whip up meals for customers on the spot.

As China’s largest e-commerce company, Alibaba currently has more than 617 million mobile users at its Taobao Marketplace and Tmall platforms, giving it a huge pool of users that it can tap to launch other services. Aside from e-commerce and retail investments, Alibaba has also invested in platforms that provide local services, such as flat rentals firm Mogoroom and fintech consumer loans company WeLab. Alibaba has signed a total of nine deals with platform companies since the start of 2017, in an attempt to build an ecosystem of service offerings linking payments, e-commerce and food.

TENCENT GOES TO HEAD-TO-HEAD ON NEW RETAIL

Not to be outdone, Pony Ma Huateng’s Tencent has spent about US$778 million since 2017 to strengthen its offline retail presence, pitting itself against Alibaba in the “new retail” landscape by acquiring stakes in Chinese supermarket chain Yonghui Superstores and retail chain Better Life Commercial Chain Share Co.

Shenzhen-based Tencent originally built its empire on gaming. The company has established itself as the world’s largest gaming firm, creating blockbuster titles such as Honour of Kings as well as launching popular battle royale games, such as Fortnite and PlayerUnknown’s Battlegrounds.

Tencent has also become a force in social media. It first developed the instant-messaging service QQ and later, the multi-purpose mobile messaging-social network-and-mobile payments platform WeChat, which recently crossed a billion users. WeChat, known as Weixin on the mainland, also offers e-commerce and food delivery services, all at a user’s fingertips and without them ever needing to leave the platform.

Tencent diversified by investing in Chinese online grocer Miss Fresh last year, and extended its e-commerce investments to second-hand car platforms, such as Chehaoduo and Renrenche. It has also poured money into the logistics arm of e-commerce ally JD.com, leading a US$2.5 billion fundraising round. Subsequently, Tencent and JD.com together invested some US$863 million in Chinese e-commerce platform VipShop to form an alliance that could rival Alibaba.

Tencent was recently criticised in an online essay by veteran tech editor Pan Luan, who claimed the company had “lost its dream” by becoming an investment company instead of continuing to develop great organic products in core areas. The article has triggered heated debate, with some arguing the firm may be losing its innovative edge while others say it is setting itself up for successful, long-term growth.

The investments Tencent have made are “complementary to their core businesses, in the sense that they either add content or capabilities to the ecosystem that’s been built around its social media, gaming and entertainment businesses”, said John Hall, co-head of JP Morgan’s investment banking unit in Asia-Pacific and global head of technology services.

Alibaba and Tencent’s heavy spending had spooked investors ahead of earnings releases this month, as fears mounted over looming margin pressures. Both companies, however, surprised on the upside.

Tencent beat analysts’ estimates by about a third to report a 61 per cent first quarter profit, but flipped to net debt of 14.5 billion yuan as of March 31, from a position of net cash at the end of last year – as a direct result of its investments and M&A activity. Earlier this month, Alibaba saw net income for its March quarter decline by 33 per cent to 6.6 billion yuan but its overall results were better than expected.

In contrast, Baidu’s deal-making pace has fallen behind its competitors. In 2017, Baidu closed 13 deals, about four times less than the number of deals Tencent took part in over the same period, according to Bloomberg data.

Last year, Baidu acquired or invested in eight artificial intelligence (AI) start-ups as well as in Chinese carmakers WM Motors and NIO, as it looked to scale back other businesses to focus on AI as its growth driver. In April, Baidu sold its stake in food delivery platform Ele.me to Alibaba, exiting the industry entirely. Last week, video platform iQiyi said it will take over Baidu’s movie ticketing business, a step that could free up more resources for the latter’s expansion into AI.

TO INFINITY AND BEYOND!

Investment data from China’s largest tech companies shows not only an evolution of their existing strategies – it also reveals an array of moon shot ventures and new industry bets, ranging from space exploration to the health and fitness industries.